Warren Buffett Predicts Berkshire's Cash Holdings to Surpass $200 Billion

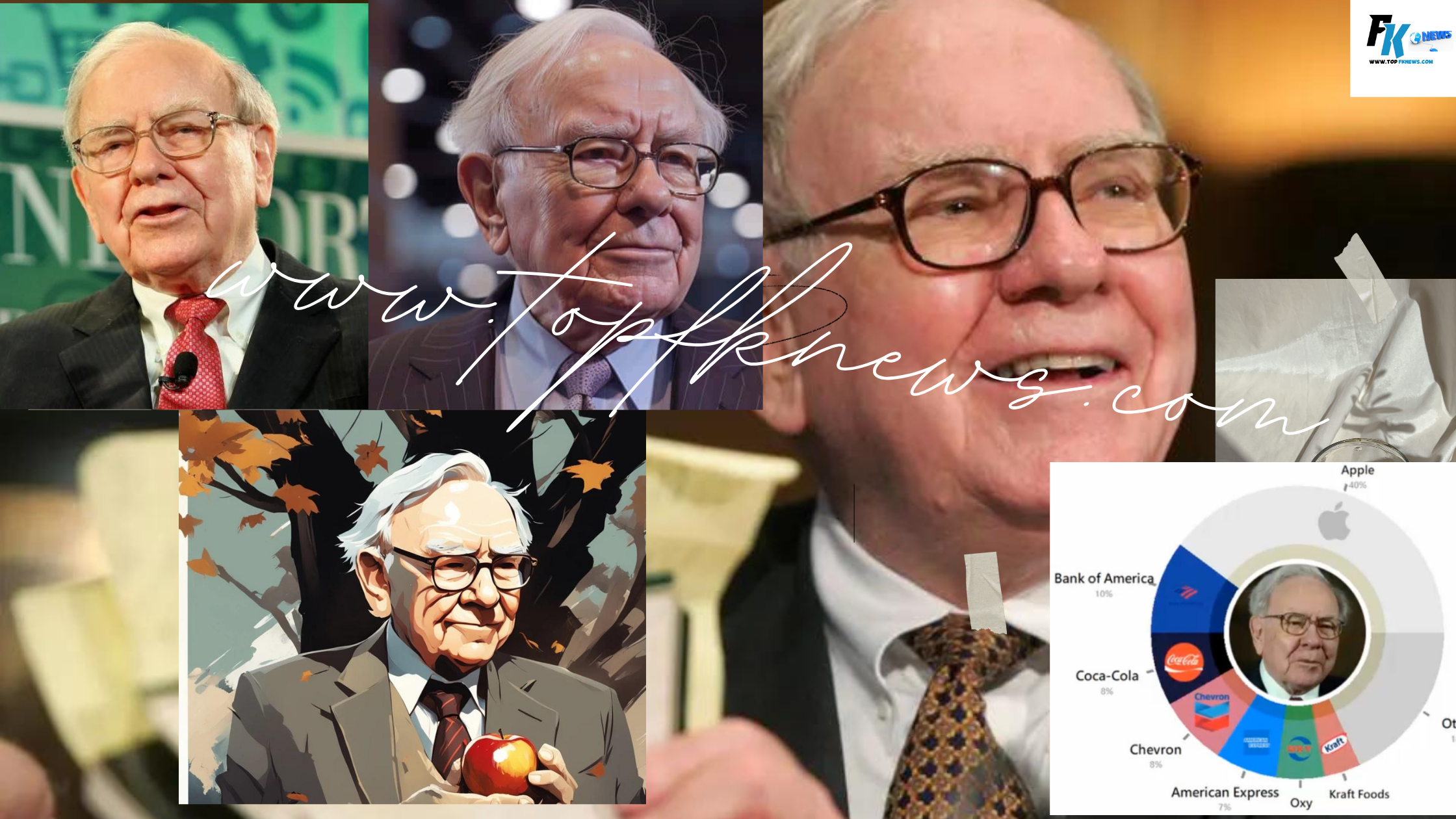

Warren Buffett manages Berkshire Hathaway’s extensive portfolio, currently valued at about $400 billion. Apple is the largest holding, with a stake worth around $173 billion, acquired between 2016 and 2018. However, Buffett anticipates that Berkshire’s cash and cash equivalents, primarily invested in short-term Treasury bonds, will exceed $200 billion when the company reports its second-quarter earnings in early August.

Warren Buffett's Conservative Approach to Berkshire's War Chest

Warren Buffett hasn’t found many appealing opportunities in the stock market lately, selling more equities than he bought for six consecutive quarters as of Q1 this year. This includes two quarters of selling Apple shares. The upcoming August earnings report might show more stock liquidations, especially after selling $2.3 billion in Bank of America stock in July, potentially extending the streak to eight quarters.

Combining these sales with Berkshire Hathaway’s operational cash flow has rapidly increased their cash reserves. Berkshire’s Treasury holdings surged from $109 billion at the end of Q3 2022 to $189 billion 18 months later. Buffett acknowledges this is excessive, describing it as an “insurance policy” in his latest shareholder letter.

Buffett prefers short-term Treasury bills, avoiding long-term bonds after a costly mistake in the 1970s when inflation and rising rates diminished the value of 15-year bonds. At this year’s shareholder meeting, he stated a preference for safety over yield in short-term investments. Despite having substantial funds, Buffett emphasized the challenge of finding low-risk, high-reward opportunities to deploy such large sums, fitting his strict investment criteria.

Buffett's Strategy Highlights Challenges and Opportunities for Investors

The advantage for most investors is that they typically manage portfolios far smaller than the $600 billion in equities and Treasuries overseen by Warren Buffett. This smaller scale offers more flexibility in making investment decisions.

However, Buffett’s increasing investment in Treasuries and difficulty finding strong opportunities for Berkshire Hathaway shareholders indicate that good investments are becoming harder to find, regardless of portfolio size. Despite this, the S&P 500 has returned about 57% since Buffett began selling more equities than he bought in Q4 2022.

Berkshire Hathaway has performed well during this period, with its share price rising 64% and its operations thriving. Meanwhile, its Treasury bill holdings yield around 5.3%. Berkshire might be even more valuable if Buffett hadn’t sold equities over the past six quarters, though his decisions were based on sound reasoning.

Buffett’s top advice for investors remains to buy an S&P 500 index fund, which he recommends even over Berkshire stock. He believes Berkshire will likely outperform the index over the next decade but won’t guarantee it. Nevertheless, Berkshire stock appears to be a solid investment now. Long-term investors should limit their exposure to Treasury bills unless they need short-term liquidity.

Warren Buffett recommends investing in an S&P 500 index fund because it offers broad market exposure and has a strong historical performance. Although he believes Berkshire Hathaway is likely to outperform the index over the next decade, he acknowledges that this isn’t guaranteed. Index funds provide a low-risk, diversified investment option suitable for most investors.

Buffett has increased Berkshire Hathaway’s investment in Treasury bills due to the difficulty of finding attractive investment opportunities. Treasury bills offer a safe, though modest, return with yields around 5.3%. While Berkshire’s substantial holdings in Treasuries indicate a cautious approach, the company has still performed well, with its share price up 64% since Q4 2022. For individual investors, this suggests that maintaining some exposure to Treasury bills is prudent for short-term liquidity needs, but they should consider more dynamic investments for long-term growth.