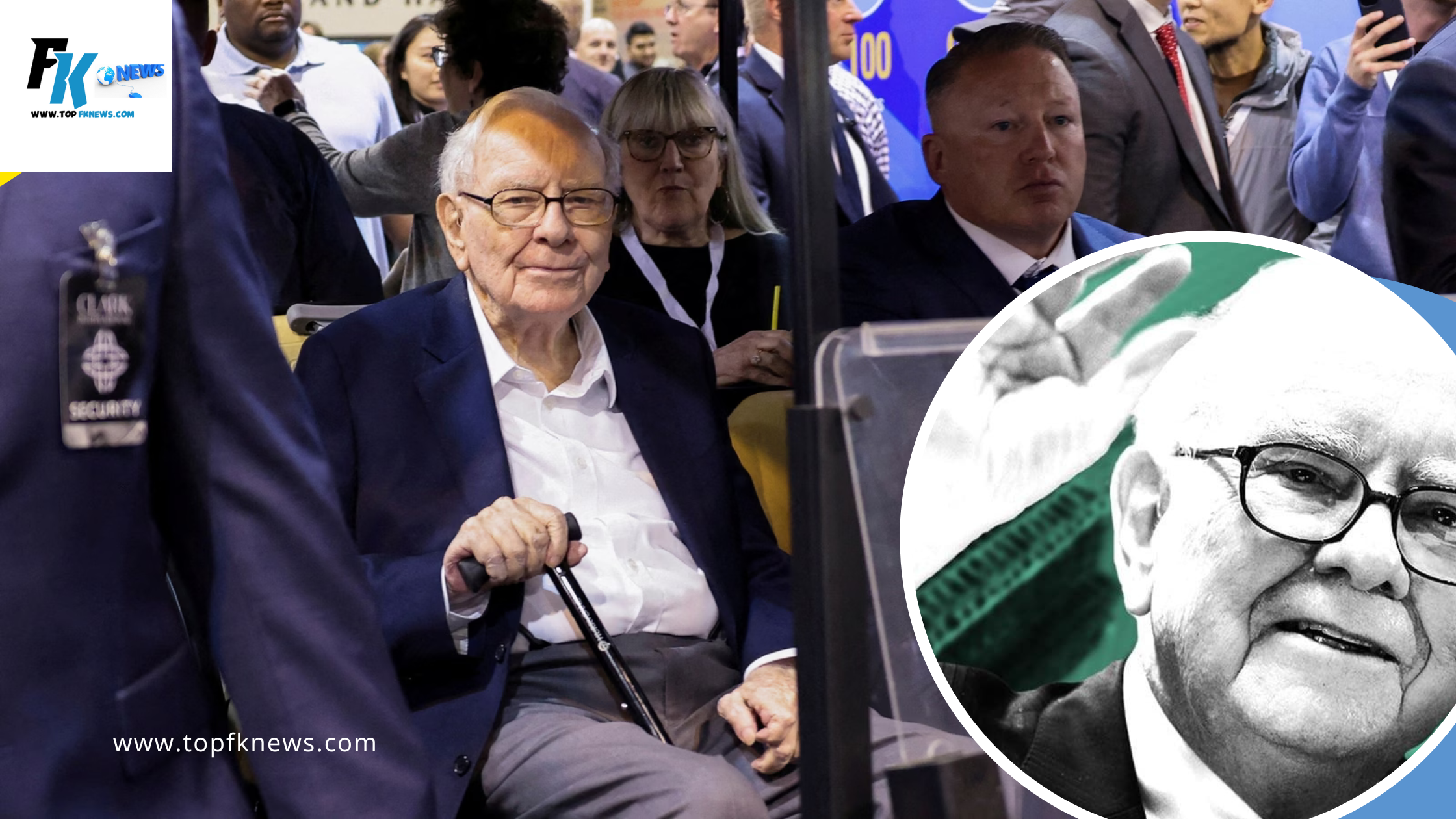

Warren Buffett continues to sell stocks, as Berkshire Hathaway has been a net seller of equities for six consecutive quarters. It’s likely that this trend will continue for a seventh quarter when Berkshire reports next month, and now Buffett is moving towards an eighth consecutive quarter with another major stock sale.

A recent SEC filing disclosed that Buffett sold $1.5 billion of Berkshire Hathaway’s second-largest equity holding, Bank of America. This sale only reduced Berkshire’s stake in the bank by 3.3%, but it could be just the beginning.

Bank of America has been a highly successful investment for Buffett and Berkshire Hathaway shareholders. Despite Buffett’s well-known preference for holding investments “forever,” he is now choosing to sell some shares. So, what is prompting this decision?

Withdrawing funds from the bank

There are a few reasons why Buffett might have decided to sell some of his Bank of America stock.

First, after a strong performance over the past eight months, the shares are trading at levels not seen since early 2022. Despite the solid financial and operational performance that has driven this price increase, Buffett might think the shares have reached their full value, prompting him to cash in.

Another reason could be related to tax considerations. Buffett’s average purchase price for Bank of America shares is just over $14. This means that a significant portion of the sale proceeds is taxable gains. By selling now, Buffett can lock in these gains at the current favorable tax rate of 21%, which he expects to rise in the future.

Recently, Buffett hasn’t hesitated to take profits on some of his favorite stocks. He sold billions worth of Apple shares in the last two quarters. At the annual shareholder meeting in May, he explained that he was comfortable paying taxes at the current rate, anticipating that it might increase in the future. Despite these sales, Buffett mentioned that Apple would likely remain Berkshire Hathaway’s largest equity holding for some time.

The same reasoning might apply to his recent sale of Bank of America shares. This suggests that while Buffett still believes in the business and the stock, he doesn’t expect it to grow as rapidly as it has in the recent past, at least not enough to justify paying higher taxes on the gains later.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

yes please